Bankruptcy Gambling Losses

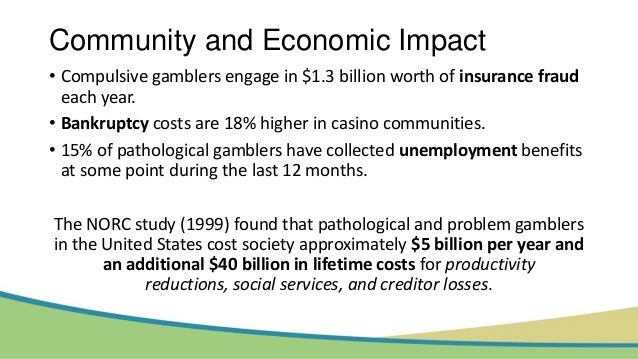

Have some big losses at an Atlantic City casino contributed to the financial situation you find yourself in that has you considering bankruptcy? You may wonder if gambling debts can be discharged in Chapter 7 bankruptcy. The good news is that they likely can be. However, you might get some pushback from the bankruptcy trustee assigned to your case. Gamblers sometimes end up filing for bankruptcy. Incurring excessive gambling losses and gambling debts can often lead to filing for bankruptcy. In fact, in the official bankruptcy forms needed to file a bankruptcy, there is a question that specifically asks about gambling losses. Gambling debts for the most part, are dischargeable in bankruptcy. GAMBLING DEBT Are Gambling Debts Dischargeable In Bankruptcy? Gambling debts are generally dischargeable in bankruptcy like other types of unsecured debts, such as credit cards and personal loans. However, there may be exceptions to the discharge of particular gambling debts under certain circumstances. Gambling debts typically arise as credit card charges or as. Between June and November of 2006, Debtor accumulated approximately $40,000 in credit card debt from gambling losses on online internet sites. In November, realizing she was in trouble, she consulted an attorney, cancelled her internet service, and attempted unsuccessfully to negotiate an affordable repayment plan. The top reasons for filing for bankruptcy are insurmountable medical bills and student loan debt. However, bankruptcy can be used to discharge, reduce, or otherwise manage all forms of debt, including gambling debt. Oftentimes, these debts are borrowed from credit cards at high interest rate cash advance, or through the casino using a marker.

- Bankruptcy And Gambling Losses

- Bankruptcy Gambling Losses Definition

- Bankruptcy Gambling Losses Offset

Discharge of Gambling Debts in Bankruptcy

Maybe you like to bet on horse races. Maybe it’s sports. Maybe you like to play blackjack, craps, or poker. You place a couple of bets and you lose. Then you place a couple more so you can win back what you lost. You win some, you lose some, and before you know it you’re borrowing piles of cash to keep the cycle going. Now you can’t repay your gambling debts and your other debts are mounting, too. Collectors are calling, they’re threatening to repossess your car and foreclose on your home, and you’re out of options. We see this scenario unfold frequently in the Atlantic City area. Is bankruptcy a way out?

Bankruptcy And Gambling Losses

How Bankruptcy Works

Bankruptcy is a powerful tool. It can protect you from creditors and give you a fresh financial start. Most importantly, it can wipe out your debt. Consumers generally file one of two main types of bankruptcy: Chapter 7 and Chapter 13 (link to one of our articles about different kinds of bankruptcy). Under Chapter 13, you’ll work with your creditors and the court to create a debt repayment plan. Generally you’ll pay all of your disposable income toward your creditors. At the end of five years, the court will discharge your remaining debt. Under Chapter 7 bankruptcy, the court’s bankruptcy trustee will take control of your non-exempt assets and sell them to repay your unsecured creditors. The court will then discharge whatever debt remains.

Non-Gambling Debt

Bankruptcy Gambling Losses Definition

For debts unrelated to gambling, bankruptcy can definitely help. Depending on which type of bankruptcy you choose to file and where you live, you may even be able to keep your home, your car, and other important assets. You’ll pay what you can to your unsecured creditors and the court will discharge the rest of your debt.

Gambling Debt

While gambling debt is technically dischargeable in bankruptcy, it’s a slightly more complicated proposition in the bankruptcy court than other types of debt. No law specifically prohibits the discharge of gambling-related debt, but the court looks at it differently than other types of debt. Most importantly, the bankruptcy trustee or creditor may object to your discharge on the ground that you incurred the gambling debt with no intention of repaying it and tried to file for bankruptcy as a way out.

A debt incurred under false pretenses or through fraud is nondischargeable in bankruptcy. 11 U.S.C.A. 523(a)(2)(A). The problem here is that false pretenses and fraud are tough to prove in court. Making any statement with intent to deceive your creditor may be sufficient to prevent your discharge. For example, when you gamble at a casino you might sign a marker in exchange for chips. If you sign a marker claiming that you have sufficient funds to cover the chips when you do not actually have those funds, the court may find that you borrowed deceptively and deny your discharge. In re Ridge, 2010 WL 3447669 (Bankr. E.D. Va. 2010). If you can prove that you genuinely intended to repay your debts, however, you may still be able to obtain a discharge. For example, if you realize your gambling debt is out of control and you stop gambling, seek help, and make whatever payments you can, you’ll show the court that you weren’t just trying to escape debt. In re Baum, 386 B.R. 649 (N.D. Ohio, 2008). The case law is unclear, but a good rule of thumb is that your gambling debt will be dischargeable if you subjectively believed that you would be able to repay it and tried to do so.

One way to seriously endanger the discharge of your gambling debt is to incur it right before you file for bankruptcy. If you take on gambling debt right before you file for bankruptcy (within 60-90 days), the court will assume you never meant to pay. If you’re considering filing for bankruptcy, make sure you wait for a few months after taking on new debt.

What will happen to my gambling debt?

Bankruptcy Gambling Losses Offset

Gambling debt may be secured or unsecured. If you took out personal loans to gamble, that debt is unsecured. It can be discharged through either Chapter 7 or Chapter 13. If you borrowed against the equity in your home, car, or other valuable asset, the gambling debt is secured. In that case, the lender may be able to claim the collateral as repayment for the debt. If other lenders (such as your home or auto loan provider) still hold liens on the property, they may claim the property and force other lenders to convert your debt to unsecured debt.

With the help of an experienced attorney, you should be able to get a discharge of your unsecured gambling debt. In order for a lender to block the discharge of your gambling debt, the lender has to win an adversary proceeding. That means the lender will have to prove that you borrowed money with no intention of repaying it. That’s a difficult point to prove. To improve your case, consider seeking professional help for gambling addiction. First, it will help you stop gambling now and avoid it in the future. Second, it will show that court that you’re not planning to turn around and rack up more gambling debt as soon as it discharges your old debt. With a small display of good faith, bankruptcy can wipe out your gambling debts and give you a fresh start.